For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available. To present a clearer picture of the two methods, there are some examples presented below. When you have no other information for the account, you assume the change was all cash. You may need to adjust for exchange rate fluctuations if you have cash or cash equivalents in a foreign currency like Meta does.

What is the Statement of Cash Flows?

Non cash expenses are added to net income on the indirect cash flow statement. Non cash revenues and expenses are not reported on the direct cash flow statement. The CFS is one of the most important financial statements for a business.

Chart of Accounts

- More than 80% of small businesses fail because of cash flow problems.

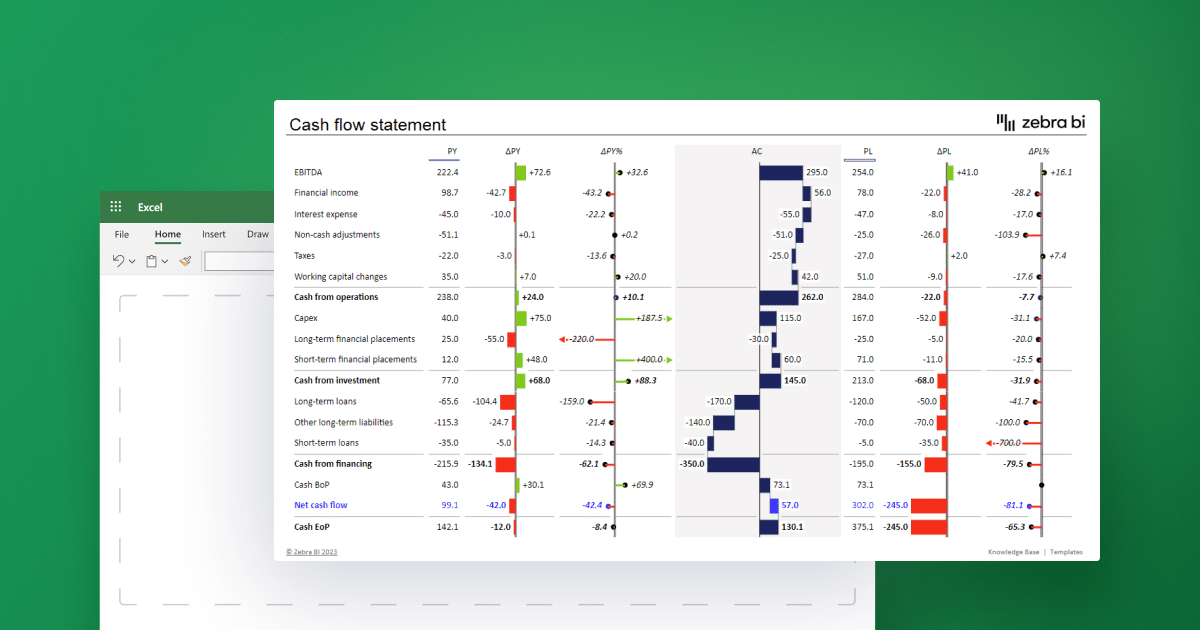

- The cash flows from operating activities section provides information on the cash flows from the company’s operations (buying and selling of goods, providing services, etc.).

- The statement of cash flows analyzes cash receipts and payments to show how cash was acquired and spent during the accounting period.

- You can think of this section as the company investing in itself.

- The change in cash should agree with the change in cash on the balance sheet.

In fact, it doesn’t appear anywhere on the cash flow statement when using the indirect method because it’s already factored into your net income. Simply add three headings in your cash flow statement (cash flow from operating, investing, and financing activities) and list cash transactions as explained in the next section. If the starting point profit is above interest and tax in the income statement, then interest and tax cash flows will need to be deducted if they are to be treated as operating cash flows. Clearly, the exact starting point for the reconciliation will determine the exact adjustments made to get down to an operating cash flow number. A statement of cash flows must be included in all financial reports that contain both a balance sheet and an income statement.

What Can the Statement of Cash Flows Tell Us?

For example, capital expenditures require a cash payment, which means cash flows out. Monitoring the company’s cash flow helps you prepare for a potential cash crunch. You can take action to maintain liquidity so you don’t have to hit pause on growth if your customers are late on their payments. After a stint in equity research, he switched to writing for B2B brands full-time.

How comfortable are you with investing?

We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. The change is the amount reported when there is no additional information. Long Term Debt increased this year, therefore, the company borrowed money. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

This amount will be reported in the balance sheet statement under the current assets section. This is the final piece of the puzzle when linking the three financial statements. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

Under this method the starting point is the net income reported on the income statement. A company’s understanding of its cash inflows and outflows is critical for meeting its short-term and long-term obligations to its suppliers, employees, and lenders. Current and potential lenders and investors are also interested in the company’s cash flows. LO 16.3Use the following information fromManuscript Company’s financial records to determine net cash flowsfrom financing activities.

For instance, a company with positive and consistent cash flow from operations likely has strong liquidity, suggesting it can meet its immediate expenses, pay salaries, and handle unexpected costs. This assessment is critical for investors and creditors who are interested in the company’s ability to sustain daily operations without relying on additional debt. The relationship between net income and cash flow is crucial because net income alone does not provide a complete picture of a company’s financial health. Net income includes non-cash items like depreciation and accounts receivable, which do not immediately affect cash flow.

LO 16.5The following shows excerpts from financialinformation relating to Aspen Company and Bergamot Company. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please what is the difference between the current ratio and the quick ratio review the Program Policies page for more details on refunds and deferrals. No, all of our programs are 100 percent online, and available to participants regardless of their location. There are no live interactions during the course that requires the learner to speak English.

LO 16.3Use the following excerpts from NutmegCompany’s financial records to determine net cash flows fromoperating activities and net cash flows from investingactivities. LO 16.3Use the following information from KentuckyCompany’s financial statements to determine operating net cashflows (indirect method). LO 16.3Use the following information from JumperCompany’s financial statements to determine operating net cashflows (indirect method). LO 16.3Use the following information from HamlinCompany’s financial statements to determine operating net cashflows (indirect method). LO 16.3Use the following excerpts from GrenadaCompany’s financial records to determine net cash flows fromoperating activities and net cash flows from investingactivities.